AWS Public Sector Day Singapore 2025

30 September 2025, Raffles City Convention Centre

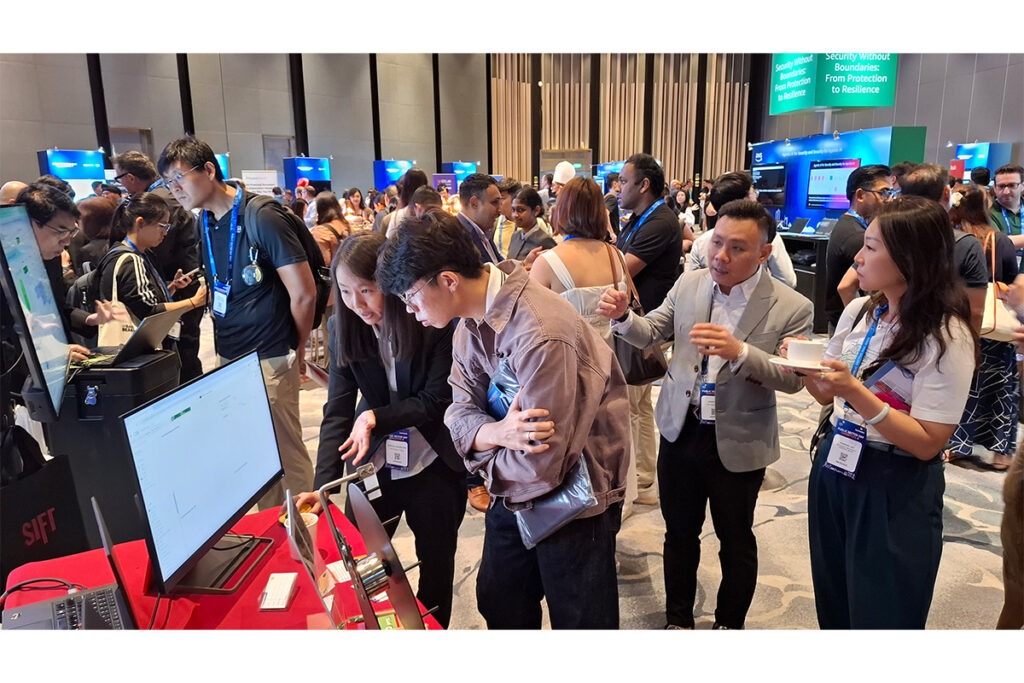

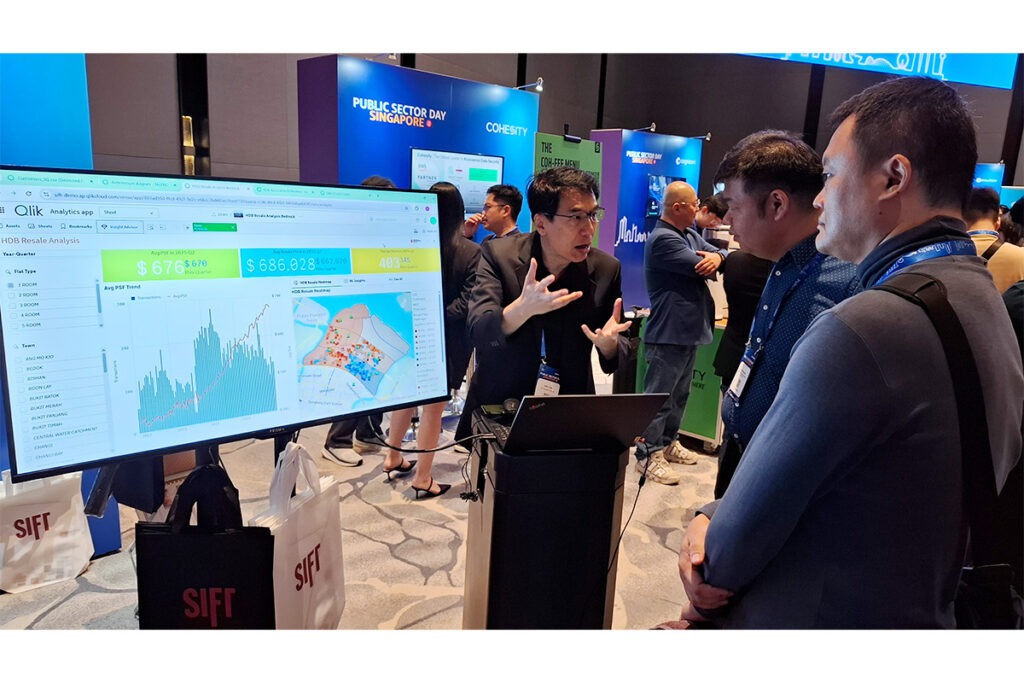

We were honoured to participate alongside Qlik at AWS Public Sector Day Singapore 2025.

On stage, our Sales Director, Edwina Hun, shared how organisations can do data differently, overcome real-world AI challenges, and empower teams to make timely, informed decisions. Together, we are building trust, driving efficiency, and turning innovation into measurable value and outcomes.

The main highlight of the day was engaging directly with attendees, understanding their challenges and showing how AI-driven solutions, grounded in a strong data foundation, can create tangible, real-world impact.

Thank you to everyone who visited our SIFT | Qlik booth. Also, congratulations to the 3 lucky winners taking home delightful Snowskin mooncakes!

For more information or enquiries about Qlik products and services, feel free to contact us below.

Snowflake World Tour

23 September 2025, Sands Expo & Convention

For more information or enquiries about Qlik products and services, feel free to contact us below.

Today’s students expect more than just lectures. They seek a connected, modern learning environment where technology powers every step of their academic journey.

As a trusted campus technology partner, SIFT Analytics helps universities transform education by integrating industry-aligned skills, AI-driven IT operations, and student-focused innovation.

Equip students with the in-demand skills employers value most.

Deliver seamless, efficient IT support across campus.

Connect students with internships and real-world projects

Recognize and reward student achievements in analytics and innovation.

By partnering with SIFT Analytics, your institution can differentiate itself as a forward-thinking, digitally empowered campus, attracting students, empowering faculty, and aligning education with the needs of tomorrow’s industries.

Tax

Analytics

SIFT’s solution for tax analytics automates the aggregation, cleansing, and standardization of tax data from multiple jurisdictions into a unified workflow. Advanced analytics and built-in validation rules ensure accurate calculations, compliance with regulatory requirements, and full auditability. The framework accelerates reporting cycles, reduces manual errors, and provides actionable insights for tax planning and risk management.

Month-End

Close

SIFT’s solution for month-end close automates the preparation of journal entries, data consolidation, and variance analysis across financial systems. Standardized workflows ensure accuracy, reduce manual effort, and enable faster close cycles. The framework provides audit-ready outputs and real-time visibility into financial performance.

Faster, more accurate month-end close

Reduced manual effort and errors

Automated variance analysis and reconciliation

Transparent, audit-ready financial workflows

Improved visibility into financial performance

Regulatory Reporting

SIFT’s solution for regulatory reporting automates the aggregation, validation, and transformation of data to generate CCAR, Basel, and DFAST-compliant reports. Governed workflows ensure traceability, accuracy, and adherence to regulatory standards, while automation reduces manual effort and supports timely submissions.

Accurate, compliant, and audit-ready regulatory reports

Reduced manual effort and reporting errors

Full traceability and governance across data workflows

Faster reporting cycles with reliable outputs

Scalable framework adaptable to evolving regulatory requirements

General Ledger Reconciliation

SIFT’s solution for general ledger reconciliation automates the matching, validation, and exception handling of financial transactions across systems. Standardized workflows reduce reliance on manual Excel processes, ensure accuracy, and provide audit-ready records.

Treasury Forecasting

SIFT’s solution for treasury forecasting integrates real-time data from treasury and financial systems to project daily liquidity and cash balances. Automated workflows cleanse, consolidate, and validate inputs, while predictive models generate accurate forecasts to support decision-making and cash management.

Credit Risk Scoring and Monitoring

SIFT implements an automated data pipeline that ingests structured and unstructured financial data from multiple internal and external sources, applies data cleansing and normalization techniques, and then leverages advanced scoring models with machine learning-driven risk segmentation. Real-time monitoring dashboards are built with rule-based triggers to continuously track credit exposures across customers, portfolios, and counterparties.

More precise view of default risk and exposures

Dashboards detect credit deterioration quickly

Auditable data lineage ensures regulatory alignment

Liquidity & Capital Stress Testing

SIFT implements a scenario-based simulation framework that integrates historical and real-time financial data to model adverse market conditions. Advanced stress-testing algorithms project capital adequacy and liquidity coverage under regulatory requirements, while automated dashboards provide continuous monitoring and exception reporting.

Identify potential liquidity or capital shortfalls before they materialize

Ensure alignment with Basel, CCAR, and other regulatory standards

Generate actionable reports for strategic decision-making

Operational Risk Event Analysis

SIFT implements an automated operational risk analytics framework that aggregates loss event data from multiple sources, cleanses and standardizes it, and applies advanced pattern recognition and root-cause analysis algorithms. Interactive dashboards highlight trends, anomalies, and risk hotspots for timely investigation.

Quickly identify recurring issues and high-risk areas

Automation reduces manual effort in analyzing loss events

Insights support targeted actions to prevent future losses

Model Risk Validation

SIFT implements an automated model validation framework that continuously tests and monitors model performance using historical and real-time data. Advanced analytics detect deviations, bias, and model drift, while dashboards provide governance, transparency, and compliance with SR 11-7 guidelines.

Regulatory Risk Reporting

SIFT implements an automated regulatory reporting framework that consolidates data from multiple sources, applies validation and reconciliation rules, and generates Basel III, CCAR, and ICAAP reports with high accuracy. Dashboards and alerts ensure timely submission and audit readiness.

Third-Party Risk & Vendor Management

SIFT implements an automated third-party risk management framework that streamlines vendor onboarding, risk scoring, and continuous monitoring. Integrated dashboards track vendor performance, compliance, and potential operational risks, enabling proactive mitigation.

Portfolio Risk & Performance

SIFT implements a real-time portfolio risk and performance analytics framework that integrates data across asset classes. Advanced algorithms calculate exposure, returns, and volatility, while interactive dashboards provide insights for risk-adjusted decision-making.

Clear view of exposure, performance, and volatility

Real-time analytics enable proactive portfolio adjustments

Supports strategies to maximize returns while managing risk

Client Segmentation & Personalization

SIFT implements an advanced client segmentation and personalization framework that analyzes behavioral data, wealth tiers, and investment preferences. Machine learning models identify patterns and clusters, enabling targeted marketing and customized offerings.

Understand client behavior and preferences more accurately

Deliver tailored products and services to increase engagement

Targeted strategies drive higher conversion and loyalty

Fund Flow Forecasting & Reporting

SIFT implements a fund flow forecasting and reporting framework that integrates historical and real-time transaction data to predict inflows and outflows. Automated reporting tools generate timely investor reports and dashboards, enhancing transparency and operational planning.

Predict fund movements for better liquidity management

Automated reporting reduces manual effort and errors

Clear insights for investors and stakeholders improve trust

ESG Scoring

SIFT implements an ESG scoring framework that integrates environmental, social, and governance metrics with portfolio holdings data. Advanced analytics calculate ESG scores, track performance trends, and generate automated client reports to support responsible investing.

Investment Proposal Automation

SIFT implements an investment proposal automation framework that integrates client data, risk profiles, and investment preferences to generate personalized proposals. Automated workflows ensure consistency, compliance, and rapid delivery to clients.

Reduce turnaround time for personalized proposals

Standardized templates ensure regulatory adherence

Tailored proposals improve engagement and satisfaction

Fee Leakage & Billing Reconciliation

SIFT implements an automated fee leakage and billing reconciliation framework that aggregates transaction and billing data, identifies missing or misapplied fees, and validates invoices against contractual agreements. Dashboards highlight discrepancies and generate actionable reports for recovery.

Trade Reconciliation & Exception Management

SIFT implements an automated trade reconciliation and exception management framework that consolidates trade data across multiple systems, matches transactions, and flags discrepancies. Advanced workflows handle exceptions efficiently, reducing manual intervention and accelerating settlements.

Automated matching minimizes discrepancies

Streamlined exception handling accelerates

transaction completion

Less manual effort and improved accuracy in trade processing

Pre- and Post-Trade Analytics

SIFT implements a pre- and post-trade analytics framework that collects and analyzes trade execution data, measuring slippage, market impact, and execution quality. Dashboards and reports provide insights to optimize trading strategies and evaluate broker performance.

Data-driven insights improve execution decisions

Monitor and compare broker performance effectively

Identify and mitigate factors affecting trade efficiency

Transaction Cost Analysis

SIFT implements a transaction cost analysis framework that aggregates trading data across channels and instruments, calculates explicit and implicit costs, and identifies cost drivers. Automated dashboards provide insights to optimize execution decisions and reduce trading drag.

Identify and mitigate cost drivers to improve profitability

Data-driven insights enhance trading strategy effectiveness

Clear reporting across channels and instruments supports better oversight

Algorithmic Strategy Backtesting

SIFT implements an algorithmic strategy backtesting framework that uses historical and simulated market data to evaluate trading strategies. Advanced analytics measure performance, risk, and execution metrics, while dashboards provide insights for refinement and optimization.

Market Surveillance and Compliance

SIFT implements a market surveillance and compliance framework that continuously monitors trading activity, applies anomaly detection algorithms, and automatically generates alerts for suspicious patterns. Dashboards provide oversight for regulatory and internal compliance teams.

Intraday Risk & Exposure Monitoring

SIFT implements an intraday risk and exposure monitoring framework that collects real-time position, margin, and exposure data across portfolios. Automated dashboards and alerts provide continuous visibility, enabling proactive risk management during trading hours.

Continuous monitoring of positions and exposures

Early detection of potential issues allows timely intervention

Data-driven insights support intraday trading and risk strategies

Claims

Forecasting

SIFT consolidates historical claims data from multiple sources, ensures its accuracy through cleansing and validation, applies advanced analytics and predictive modeling to uncover trends and forecast future claims, and provides interactive dashboards for real-time monitoring and strategic planning.

Fraud Detection & Prevention

SIFT automates fraud detection by consolidating claims and behavioral data from multiple sources, cleansing and standardizing it for consistency, and applying anomaly detection and predictive modeling techniques to flag suspicious patterns in real time. Automated workflows route flagged claims for investigation, while dashboards provide visibility into fraud trends and model performance.

Claims Processing Optimization

SIFT automates claims handling by integrating data from multiple systems, cleansing and validating inputs for accuracy, and streamlining workflows to reduce repetitive manual tasks. Dashboards provide visibility into processing times, exceptions, and overall performance, enabling proactive improvements.

Payment Integrity Analysis

SIFT automates payment integrity analysis by consolidating claim data across sources, applying validation rules and anomaly detection to flag irregularities, and highlighting potential overpayments or duplicate claims. Automated workflows surface recovery opportunities while dashboards track financial impact and resolution progress.

Historical Claims Trend Analysis

SIFT automates payment integrity analysis by consolidating claim data across sources, applying validation rules and anomaly detection to flag irregularities, and highlighting potential overpayments or duplicate claims. Automated workflows surface recovery opportunities while dashboards track financial impact and resolution progress.

Rate Development Acceleration

SIFT blends loss experience with market data to accelerate pricing model iterations, enabling faster and more accurate rate development while integrating insights into underwriting decisions.

Risk Adjustment

Forecasting

SIFT’s solution streamlines risk adjustment forecasting by unifying claims, clinical, and demographic data into a single workflow. Data is cleansed, standardized, and enriched for consistency before advanced models identify patterns in historical claims and patient profiles. Machine learning refines forecasts, while validation ensures transparency and compliance. The framework enables dynamic updates and delivers results seamlessly into dashboards and reporting systems.

Cash Flow & Liability Forecasting

SIFT analyzes millions of policy records to project future claims and optimize capital reserves, combining historical trends, loss patterns, and predictive analytics for accurate forecasting.

INCR Reserve Modeling Automation

SIFT replaces manual SQL or Excel processes with automated reserve modeling workflows that are dynamic, scalable, and auditable, enabling faster and more accurate reserve estimates

Financial Risk Modeling Enablement

SIFT empowers actuaries to quickly build and refine financial risk models by connecting diverse data sources and automating workflows, enabling more agile and accurate modeling.

✅ Accelerates model development and iteration cycles

✅ Improves accuracy and reliability of financial risk insights

✅ Enhances agility in responding to market and regulatory changes

Underwriting Risk Scoring Automation

SIFT automates underwriting by generating accurate risk scores from behavioral and historical data. Data is consolidated, cleaned, and enriched, then predictive models calculate risk scores and assign categories. Automated workflows integrate scoring into underwriting systems, while dashboards track trends and performance.

Submission Triage & Prioritization

SIFT automates intake and routing of broker submissions, consolidates and standardizes data, and applies predictive models to prioritize high-value or high-risk opportunities, while dashboards provide real-time visibility.

Pricing & Rate Adequacy Monitoring

SIFT analyzes quoted versus bound premium trends and loss experience, consolidates historical and current data, and applies analytics to identify underpriced or high-risk segments, with dashboards providing clear insights for pricing adjustments.

Broker Performance & Hit Ratio Analytics

SIFT tracks submission-to-bind ratios and outcomes by broker or channel, consolidates historical and current data, and applies analytics to evaluate broker performance and optimize underwriting strategies.

Real-time Eligibility & Rule Checking

SIFT automates intake and routing of broker submissions, consolidates and standardizes data, and applies predictive models to prioritize high-value or high-risk opportunities, while dashboards provide real-time visibility.

Regulatory Reporting

SIFT’s solution for regulatory reporting automates the collection, validation, and consolidation of data from multiple sources into a unified workflow. Data is standardized and transformed to meet compliance requirements, with full traceability and auditability built in. The framework reduces manual errors, supports rapid adaptation to changing regulations, and delivers outputs in ready-to-submit formats that integrate seamlessly with dashboards for monitoring and governance.

Risk Adjustment Reporting

SIFT’s solution for risk adjustment reporting unifies claims, clinical, and demographic data into a standardized workflow to generate accurate, compliant, and audit-ready outputs. Automated data cleansing, validation, and transformation ensure consistency, while embedded logic applies regulatory rules for risk score calculations. The process reduces manual effort, minimizes errors, and provides full traceability, enabling transparent audits and quick adaptation to evolving reporting requirements.

Reinsurance Treaty Processing

SIFT’s solution for reinsurance treaty processing automates ingestion and standardization of policy, claims, and treaty data. Parameterized rules handle ceding, retention, and recoverables, while automated reconciliation validates results with exception handling. Real-time updates and embedded audit trails ensure accuracy, transparency, and compliance, with outputs ready for finance and regulatory reporting.

Fraud Detection & Risk Analytics

SIFT tracks submission-to-bind ratios and outcomes by broker or channel, consolidates historical and current data, and applies analytics to evaluate broker performance and optimize underwriting strategies.

Exposure & Risk Monitoring

SIFT automates intake and routing of broker submissions, consolidates and standardizes data, and applies predictive models to prioritize high-value or high-risk opportunities, while dashboards provide real-time visibility.

Readmission Risk Prediction

SIFT’s leverages predictive modeling to identify patients at high risk of 30-day hospital readmissions. Patient data, including clinical, demographic, and historical admission records, is cleansed, standardized, and integrated into the workflow. Machine learning algorithms analyze patterns and risk factors to generate accurate, actionable risk scores. The framework enables proactive interventions, continuous model refinement, and full auditability, ensuring both clinical effectiveness and compliance with CMS guidelines.

Drug Utilization Analysis

SIFT’s solution for drug utilization analysis automates the collection, cleansing, and integration of prescription, claims, and cost data into a unified workflow. Advanced analytics identify patterns in medication usage, spending trends, and potential inefficiencies, while built-in rules flag anomalies or high-cost outliers. The framework supports dynamic reporting and audit-ready insights to optimize pharmacy benefit management and decision-making.

Clear visibility into medication usage and costs

Identification of high-cost drugs and utilization trends

Length of Stay Forecasting

SIFT’s solution for length of stay forecasting integrates patient, clinical, and historical admission data into a unified workflow. Advanced predictive models analyze patterns and risk factors to estimate inpatient stay duration, enabling optimized discharge planning and bed management. Automated validation ensures accuracy, while outputs are delivered in actionable formats for clinical and operational teams.

Accurate predictions of inpatient length of stay

Care Gap

Analysis

SIFT’s solution for care gap analysis automates the integration and cleansing of clinical, claims, and demographic data to provide patient-level insights. Predictive and rule-based analytics identify missed preventative care opportunities, enabling care teams to prioritize interventions. The framework ensures data consistency, auditability, and delivers actionable insights directly to clinical workflows.

Clinical Quality Reporting

SIFT’s solution for clinical quality reporting automates the aggregation, cleansing, and standardization of clinical and claims data into a unified workflow. Built-in logic aligns metrics with regulatory and value-based care standards, while automated reporting reduces manual effort and ensures accuracy. The framework provides audit-ready outputs and supports continuous monitoring of clinical performance and outcomes.

Cooperation Signing Ceremony between TDC and SIFT Analytics Group (HCM, Vietnam)

On the afternoon of August 28, Thu Duc College of Technology (TDC) hosted a business cooperation signing ceremony to strengthen collaboration with enterprises in practice-oriented training. The event was attended by Assoc. Prof. Dr. Pham Huu Loc, Principal of TDC, Ms. Phan Thi Thu Thuy, Country Executive Director of SIFT Vietnam, and other industry partners.

Speaking at the signing ceremony, Assoc. Prof. Dr. Pham Huu Loc, Principal of TDC, shared that the Faculty of Economics is currently one of the college’s strongest faculties, offering a wide range of key programs in the economic field.

He emphasized the importance of close collaboration with businesses to ensure training objectives align with industry requirements, while also expressing his hope that enterprises will continue to accompany and support TDC’s long-term development

Ms. Phan Thi Thu Thuy, represented SIFT Analytics in the signing of MOU with TDC.

This collaboration underscores SIFT’s role as a strategic partner of TDC, with a shared commitment to advancing education and innovation through the following key initiatives:

Delivering Data Analytics training programs tailored for business students

Providing AI-driven solutions to enhance academic programs, support research, and enable data-driven decision-making

Strengthening campus IT operations and service management

Ms. Phan Thi Thu Thuy emphasized:

Beyond being a technology provider, SIFT Analytics is committed to transforming the future of education. We strive to empower students with advanced data analytics skills, providing them with the training and technical expertise needed to thrive in today’s data-driven world.

SIFT mission extends beyond the classroom. We aim to bridge the gap between academic learning and real-world industry demands, ensuring that graduates are fully prepared to succeed.

At SIFT, every partnership with educational institutions represents an opportunity to cultivate talent, foster innovation, and nurture a new generation leaders who will shape the future.

SIFT Analytics Group (HCM, Vietnam) partners with the education sector to provide comprehensive data analytics, AI, and IT solutions that empower institutions to succeed.

Next Gen Automated AI and Analytics:

The Power of Data Automation

Key Highlights You Can’t Miss

Who Should Attend

Date: 30 September 2025 (Tuesday)

Time: 1:00 PM – 4:00 PM

Venue: Siam Kempinski Hotel Bangkok (Boardroom, 2nd Floor)

Register Here: Limited seats available

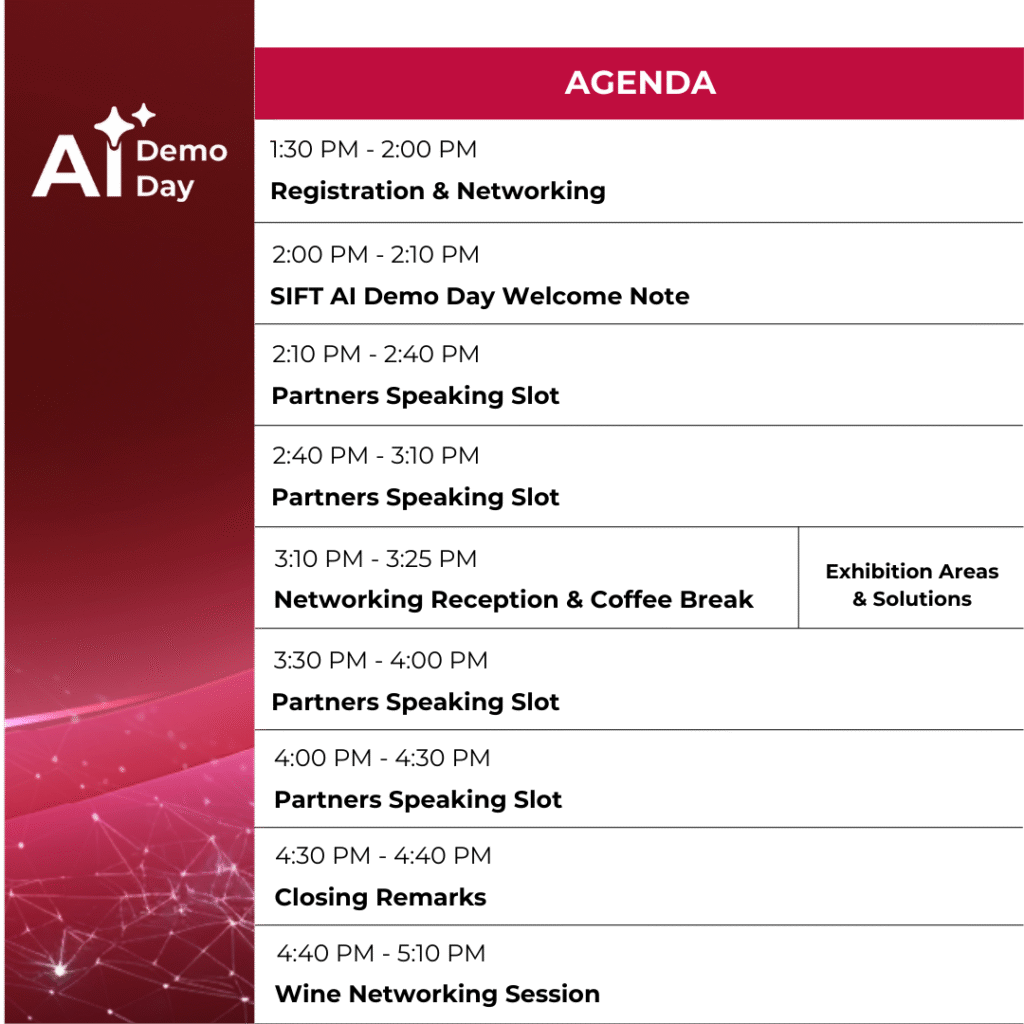

Agenda

The EDUtech CIO Roundtable

22 August 2025, SIFT Analytics Office

Modernize Campus Experience with AI-Driven Service Management

and Full IT Asset Visibility

The EDUtech CIO Roundtable is an exclusive, invitation-only event designed for education leaders and IT service delivery professionals.

Join us for a delightful high tea reception as we share how you can modernize the campus experience—enhancing IT services for students, faculty, and staff through AI-driven service management.

Participants will gain insights into:

– Manage campus IT and Non-IT processes in a single platform

– Modernize and Optimize Assets

– Use Cases & Live Demo

Agenda

Explore how institutions are streamlining IT service delivery and improving user experiences through AI-powered solutions.

Why Attend

Attending the EDUtech CIO Roundtable offers practical and valuable insights into how leading institutions are modernizing their IT service and asset management to better support students, faculty, and staff.

Who Should Attend

SIFT AI DEMO DAY

The Next Wave of GEN AI

— Practical and Proven for Real Impact.

SIFT AI Demo Day returns for its 2nd edition, you will explore latest AI applications that are transforming industries today. What’s different about this exclusive event is that you will rapidly discover the latest AI tools, solutions, and use cases, all in a single event.

AI is at the forefront of strategic discussions, but many leaders face a harder truth: the challenge of deploying data effectively. This is why this event matters, especially for leaders like you who want to drive real AI impact.

Who is Attending

Join fellow leaders to navigate this AI journey strategically with latest trends and insights.

Attendees include CEOs, CTOs, CDOs, and senior leaders such as Heads, VPs, and Directors, from both the commercial and public sector.

Why You Should Attend?

Beyond the live AI demos, you will connect with visionary peers, thought leaders, and disruptors. Gain powerful insights, anticipate change, and return with the strategies and ideas to shape the future of your industry.

Date: 16 October 2025 (Thursday)

Time: 1:30 PM - 5:00 PM

Venue: Mandarin Oriental, Atrium Suites 2 & 3, Level 1

5 Raffles Ave, Singapore 039797

Register Here

Sponsorship Partners

Venue:

Mandarin Oriental, Atrium Suites 2 & 3

Alteryx Workshop

Automating Data Validation and Compliance for BFSI

15 August 2025, SIFT Analytics Office

Designed specifically for BFSI leaders and finance professionals, this session showcases how analytics automation can dramatically streamline and enhance financial workflows in areas like data validation and compliance.

For faster, more accurate financial reporting and insights, you don’t need to be a data expert or have BI development skills. Auto Insights does the heavy lifting, and we will show you how.

Discover how leading banking, finance, and insurance organizations are automating critical operations and walk away with practical insights to drive meaningful impact in your own organization.

The workshop covered:

✔ Automate data validation and quickly clean financial data from multiple systems and spreadsheets

✔ Automate Risk Compliance for improved audit readiness and operational efficiency.

✔ Leverage Auto Insights to uncover trends, anomalies, and outliers in your financial data – automatically

✔ Empower teams with self-service analytics while maintaining governance and compliance

Why Attend

This workshop is tailored for BFSI leaders and finance professionals seeking to explore the latest trends in data validation and compliance that can potentially automate operations, minimize risk, and scale compliance across their organization.

Who Should Attend

AIBP Conference & Exhibition 2025

16-17 July 2025, Eastin Grand Hotel Phayathai

SIFT Analytics Group, in collaboration with Qlik, participated in the 25th ASEAN Innovation Business Platform (AIBP) Conference & Exhibition held at Eastin Grand Hotel Phayathai, Bangkok.

During the event, we showcased our latest Qlik data analytics solutions and delivered a featured session titled: “Do Data Differently: From Raw Data to Real Business Impact” presented by Mr. Poomchai Jitchai and Mr. Daniel Dae Wah.

The session focused on transforming raw data into actionable business outcomes and included real-world case studies on how organizations are successfully implementing data analytics. Attendees gained insights into building a data-driven culture and leveraging analytics for smarter decision-making.

A big thank you to everyone who visited our booth and joined the session — we’re excited to continue empowering businesses through data!

SIFT Analytics Group offers comprehensive end-to-end services, from strategic consulting, system implementation and customization, team training, to solution development by our data analytics experts, and ongoing post-sales support to ensure your organization maximizes the benefits from data analytics.

Analytics Consultant, SIFT Analytics Group Thailand

With over four years of experience in data analytics, Poomchai specializes in analyzing and predicting data trends. He has supported users in the F&B industry by preparing data for dashboard development. Leveraging expertise gained from a master’s degree in data science, Poomchai has contributed to a range of data analysis projects, guiding clients in the creation of machine learning models across sectors such as retail and government. His comprehensive approach to data analysis enables the delivery of end-to-end solutions that enhance organizational efficiency. This breadth of experience has provided him with a holistic understanding of business frameworks, allowing him to deliver impactful results for clients.

Data & Analytics Consultant, SIFT Analytics Group Thailand

A seasoned Data Engineer bringing over 7 years of experience in delivering impactful data

solutions across industries such as Real Estate, Retail, Hospitality, and more. With a strong

foundation in both business understanding and technical execution, helping organizations

tackle their most pressing data challenges.

Combining expertise in data engineering, specializing in building end-to-end data solutions that

turn raw data into business-ready insights. From architecting robust data pipelines and

performing advanced data transformations to crafting intuitive dashboards, readily simplifying

complex data environments. With the ability to merge back-end engineering with front-end

analytics ensures seamless, scalable, and insightful reporting tools that empower decision-

makers at every level.